Late payment has become a key battleground in the fight for the health and survival of businesses. Mobile communications and payment tools provide a win-win for both debtors and creditors.

Even prior to the pandemic, getting customers to pay on time was a challenge for UK businesses, with 24% of small businesses in 2018 reporting late payments as a threat to their survival according to the Department for Business, Energy and Industrial Strategy.

It’s not just cash flow that threatens to prevent them from paying their employees and their own suppliers. It’s also the cost of chasing payments, which research from BACS Payment Schemes estimated at £4.4 billion in 2018, as well as the strain this puts on the wellbeing of small business owners. Indeed, Pay.UK’s early 2020 survey found that late payments caused almost one in five people to doubt their ability to run a business, and 16% worried about this daily.

After a challenging year, in which almost a quarter of UK businesses temporarily closed or paused trading and redundancies hit a record high there’s little chance that these metrics will have improved.

To add to this, in some industries, government legislation temporarily restricts the means through which businesses can seek payment. For example, the Financial Conduct Authority’s (FCA) rules require lenders to offer three to six month payment holidays if needed, and extended notice periods are required for landlords seeking to evict non-paying tenants.

While these measures are there to prevent customers from getting into financial difficulties, they are still being charged interest on loans during payment holidays, and so their total amount owed will increase. Similarly, eviction is a step no landlord wishes to take, and it represents a failure to find a mutually workable solution. In many cases, continuing to receive a payment from a customer, however modest, is a better option than receiving no payment at all.

Looking at the social housing sector, which has long wrestled with the challenge of late or non-payment of rent, as many as 96% of arrears arrangements are broken or cancelled according to Voicescape, a social housing service provider. So the goal should be to keep payments flowing, and prevent non-payment from becoming the norm.

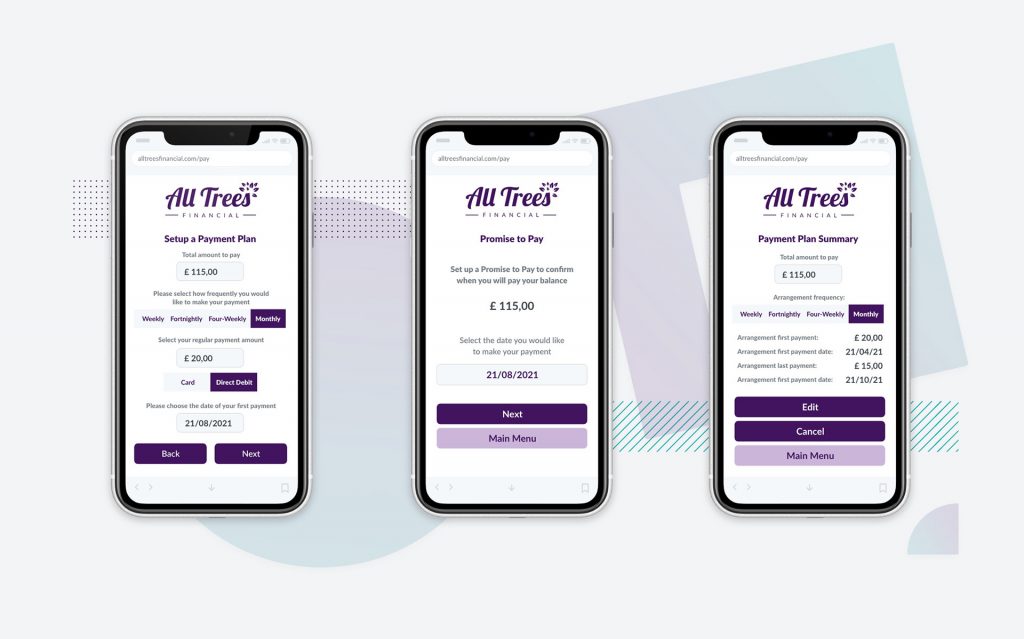

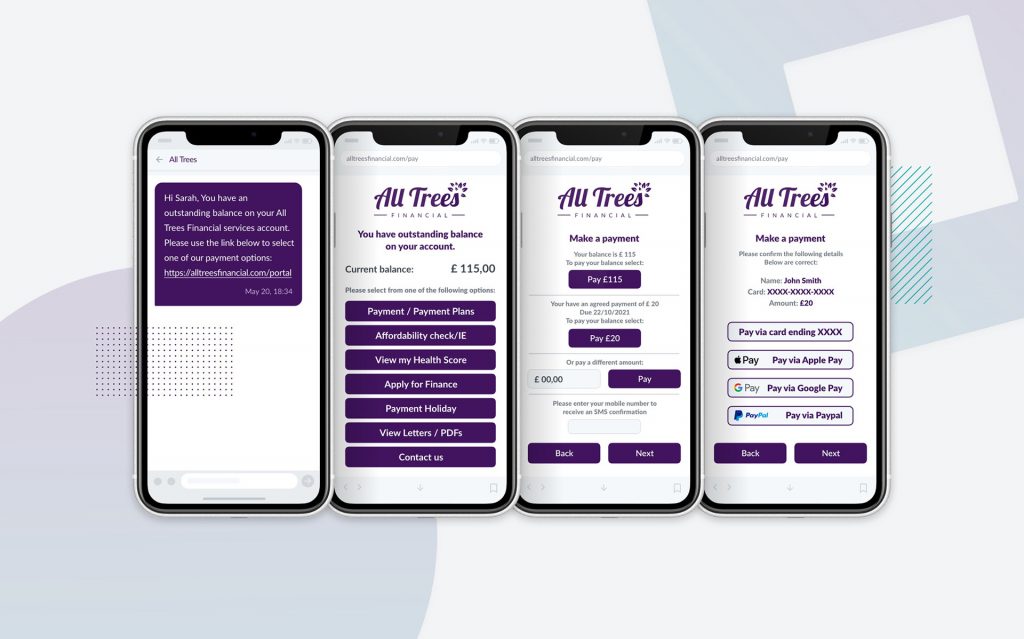

This is where a mobile collections solution comes into its own. Starting with a text message, which our research shows benefits from a 95% open rate, businesses can prompt customers to click through to a mobile payments environment – but with flexibility built in. In addition to making a secure payment directly from their mobile phone, customers can also set their own payment terms: frequency, duration and amount paid within parameters set by the business).

If customers are unable to judge what they can afford to pay, the same mobile tool can ask a series of questions in order to judge their income and outgoings, and suggest an appropriate repayment plan based on the results.

The solution is discreet; no awkward telephone conversations, no final payment demand letters, no increasingly strongly worded emails, which will in any case be ignored – the average open rate of email is 18%, according to Campaign Monitor. This places a good deal of choice in the hands of the customer, helping them feel in control of their circumstances.

An effective debt recovery strategy also improves customers’ perception of the creditor’s brand. This is important, because 51% of respondents to a 2018 survey carried out by Echo Managed Services said that they would switch service provider if they felt that they had been on the receiving end of poor debt collection practices. Conversely, 30% of customers would recommend the provider if they had been treated with respect and offered options to help self-cure their accounts.

Consequently, an effective mobile collections strategy combines a self-serve, mobile-first approach with a powerful messaging strategy. There are many messaging channels available to businesses today, from SMS to WhatsApp, Rich Communication Services (RCS) to Apple Business Chat, and the combination of channel, content, timing and message sequence is critical to a successful engagement.

The Esendex Mobile Collections solution won the Queen’s Award for Enterprise: Innovation in 2020, because it recognises the needs of all parties involved. Businesses must get paid, and equally must be sensitive to customers’ circumstances, both because it’s right, and because it’s the best way to retain customers for the long term. Flexibility in bill payments is a key application for mobile payments technology, and its time has come.

For more information, visit esendex.co.uk or reach out to us at sales@esendex.com to get in touch with our team and implement a solution tailored to your needs.